When's the best time to write a business plan?

Writing a business plan is an essential part of building a successful business. At its core, a business plan is a road map for your project: it establishes your purpose, it sets goals and expectations, and it forecasts the relationship between cost and revenue. Business plans exist in many forms: some formal and some informal.

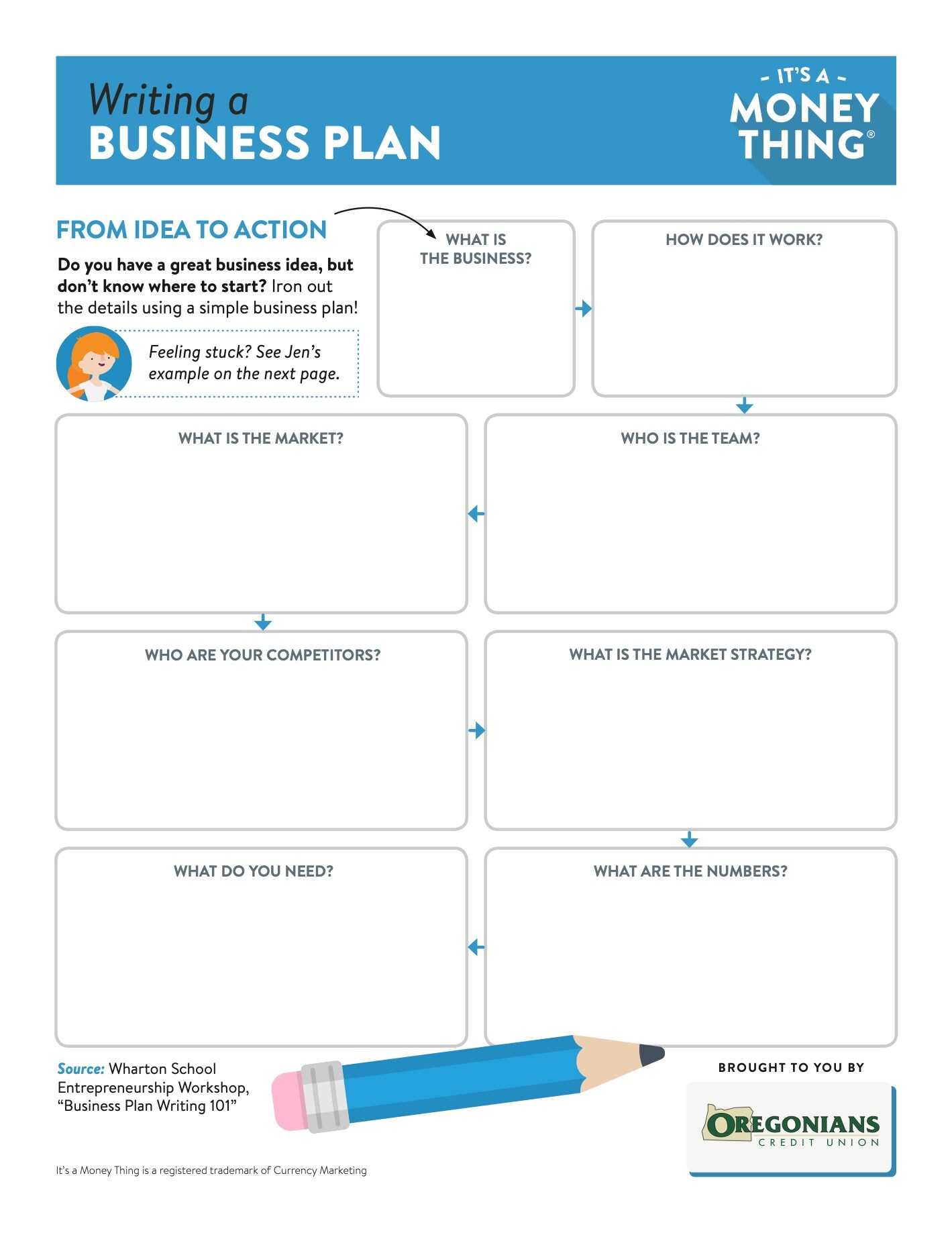

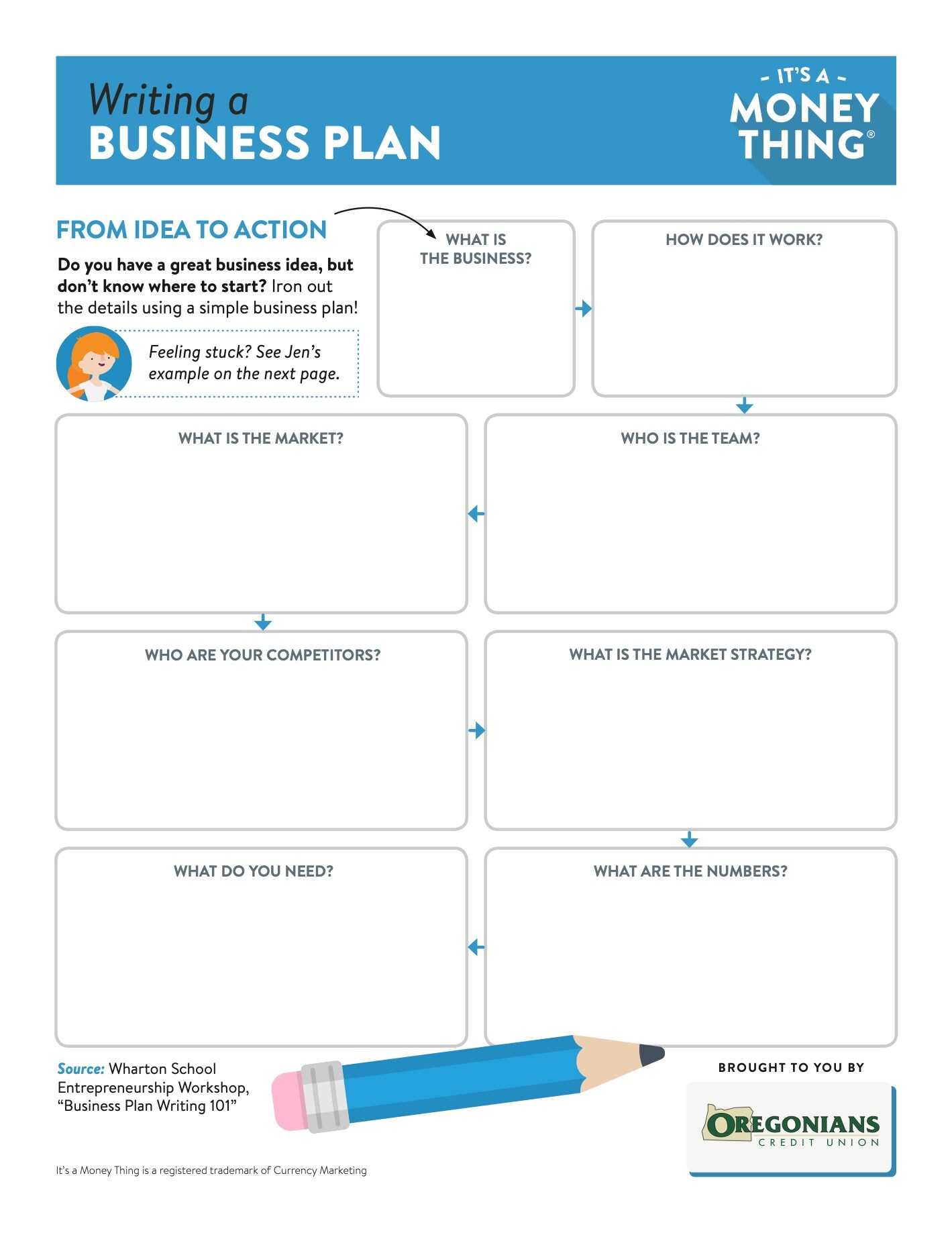

Business plan sample questions

There are many different ways to structure a business plan, but ultimately you’re seeking to answer the same basic set of questions—either for yourself, your team or an outside investor. The following list of questions, which is adapted from The Wharton School Entrepreneurship Workshop “Business Plan Writing 101,” serves as a good starting point:

- What is the business?

- How does it work?

- Who is the team?

- What is the market?

- Who are your competitors?

- What is the market strategy?

- What are the numbers?

- What do you need?

A business plan doesn’t have to be formal in order to be effective. There are valuable insights to be gained whether you answer each of the questions above in a few sentences or with pages of in-depth research. Business plans are adaptable, and you will find that the level of detail you include will change depending on what stage of business development you’re in.

The best time to write a business plan

We often think that business plans are reserved for specific high-stakes situations—like pitching to a panel of investors on a reality TV show. In fact, the process of writing a business plan can be a helpful tool at multiple points along your entrepreneurial journey. The best time to write a business plan is any time you can benefit from more focus and direction. This might be when you’re in the early stages of exploring a new idea, when you’re ready to commit to your idea, when you’ve been running your business for years, or even a combination of all three. We’ve highlighted three different phases below to demonstrate the many ways a business plan can support your vision over time.

The idea phase

The process of writing a business plan is the first step in translating a business idea into something concrete that you can act on. Daydreams about starting your own business are often hazy on the details, so it’s difficult to assess the validity of an idea without getting it down on paper. When you start to answer some basic questions about how your business will make money, you might find that your original idea has some weaknesses. Writing a business plan in the idea phase gives you an opportunity to address any overlooked areas before committing serious time and money to your new venture.

The process of writing a business plan is the first step in translating a business idea into something concrete that you can act on. Daydreams about starting your own business are often hazy on the details, so it’s difficult to assess the validity of an idea without getting it down on paper. When you start to answer some basic questions about how your business will make money, you might find that your original idea has some weaknesses. Writing a business plan in the idea phase gives you an opportunity to address any overlooked areas before committing serious time and money to your new venture.

Writing a business plan in the idea phase:

- Solidifies your idea by filling in the major details

- Identifies strengths, weaknesses, opportunities and threats related to your business

- Helps you determine whether or not your idea makes sense to pursue

- Identifies the bare minimum of what you need in order to get started

The launch phase

Your initial idea has passed the test and you’re going all in—congratulations! During the launch phase, you will likely be communicating your business idea over and over again to others. You might be assembling a team, hiring employees, registering your business, or applying for grants or loans. In each of those situations, your idea will be challenged by others and you will find yourself having to answer all sorts of questions about your business. The launch phase is therefore the perfect time to develop a comprehensive business plan. Research your industry and learn about your potential customers. Forecast costs and revenues as realistically as possible. Explore different business models and determine a pricing strategy. The more you know about your business, the easier it will be to communicate your passion with others and get what you need in order to be successful.

Writing a business plan in the launch phase:

- Determines what you need from others (like employees, vendors/suppliers or outside funding)

- Improves your expertise in the industry

- Enables you to speak confidently about your business to others

- Prepares you for questions about cash flow, profit and loss

- Identifies what makes you stand out from your competitors

The growth phase

A business plan can help you start your business, but did you know that it can still come in handy even if you’ve been successfully running your business for years? After some time, you may discover an opportunity to grow or expand your business. It’s an exciting prospect, but potentially overwhelming—that’s where your business plan can help. Rereading your business plan will remind you of the goals you established when you were first starting out. This information helps you make decisions that are in alignment with your original purpose. Revising and modifying your business plan allows you to grow in a strategic way and to include any areas that were missing from previous iterations. If your team is growing, sharing your business plan with your employees is an excellent way to connect them to your mission.

Writing a business plan in the growth phase:

- Reminds you of your goals and acknowledges the progress you’ve made

- Gives you perspective and eases decision-making

- Allows you to address new areas or concerns

- Helps you clearly communicate your vision to your team

- Realistically identifies what you need in order to grow

Whether your business is a fragment of an idea or already up and running, writing a business plan is a versatile and powerful tool that will help you run your business thoughtfully and successfully.

Activity

Do you have a great business idea, but don't know where to start? Iron out the details using a simple business plan! Click the image to open the PDF printable version that also includes Jen's example.

Was this information useful? Visit our It's A Money Thing home page for more quick videos and helpful articles to help you make sense of your money, one topic at a time! Check back, new topics will be introduced regularly.

The process of writing a business plan is the first step in translating a business idea into something concrete that you can act on. Daydreams about starting your own business are often hazy on the details, so it’s difficult to assess the validity of an idea without getting it down on paper. When you start to answer some basic questions about how your business will make money, you might find that your original idea has some weaknesses. Writing a business plan in the idea phase gives you an opportunity to address any overlooked areas before committing serious time and money to your new venture.

The process of writing a business plan is the first step in translating a business idea into something concrete that you can act on. Daydreams about starting your own business are often hazy on the details, so it’s difficult to assess the validity of an idea without getting it down on paper. When you start to answer some basic questions about how your business will make money, you might find that your original idea has some weaknesses. Writing a business plan in the idea phase gives you an opportunity to address any overlooked areas before committing serious time and money to your new venture.