To Lease or To Finance: That is the Question!

When it comes to buying a new car, you have three options: purchasing it with cash, purchasing it through a loan (also known as financing) or leasing it. For most shoppers, the decision comes down to buying or leasing.

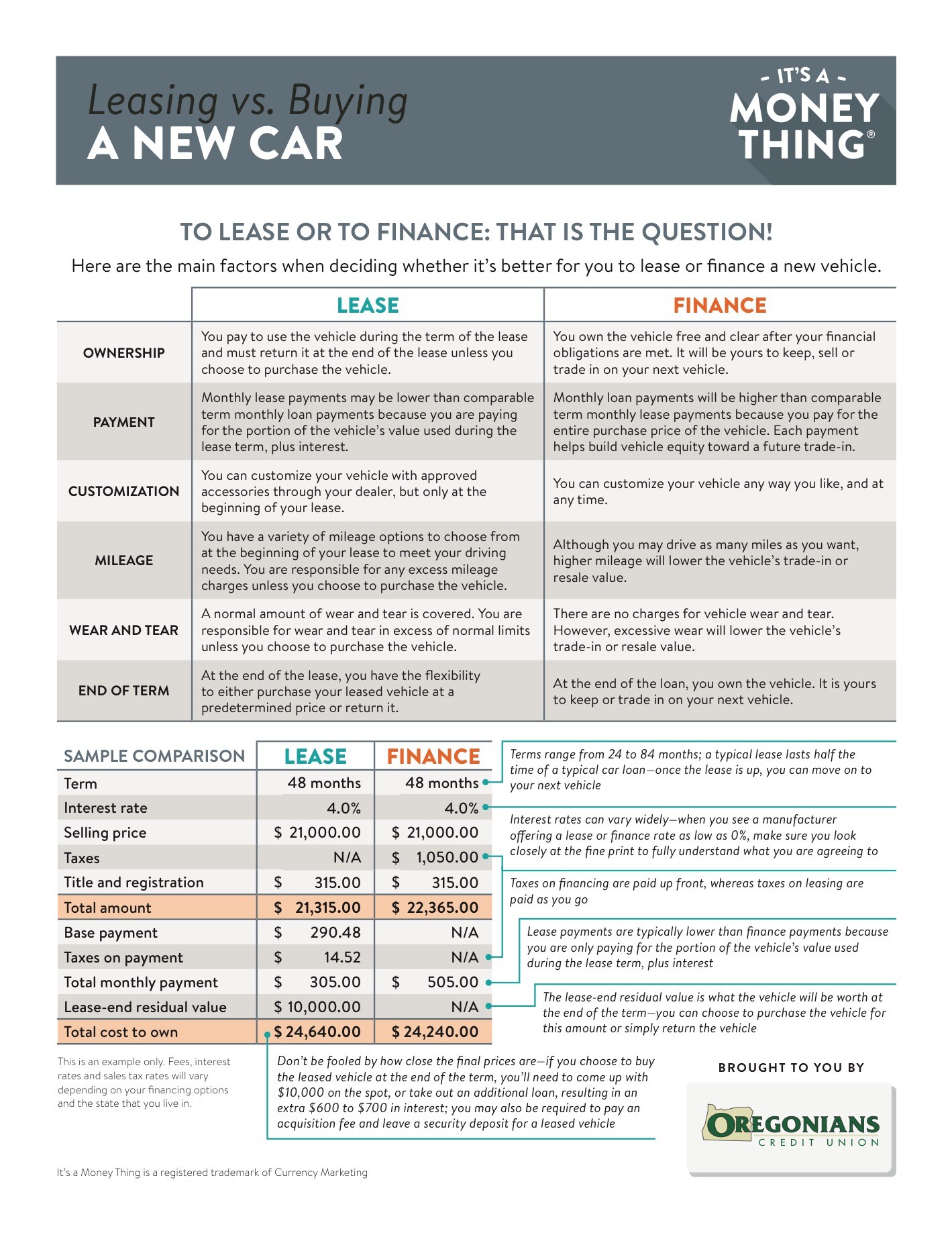

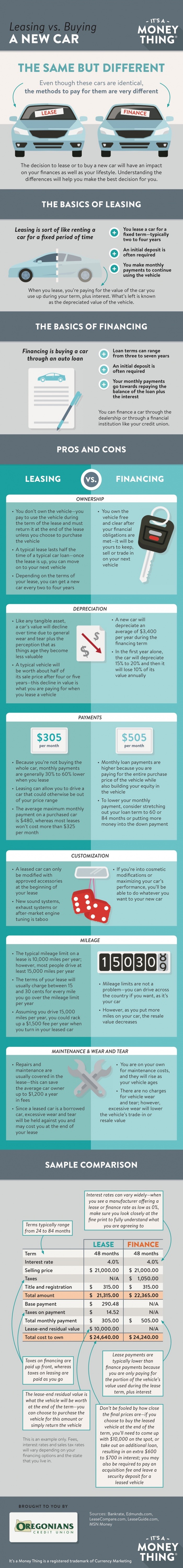

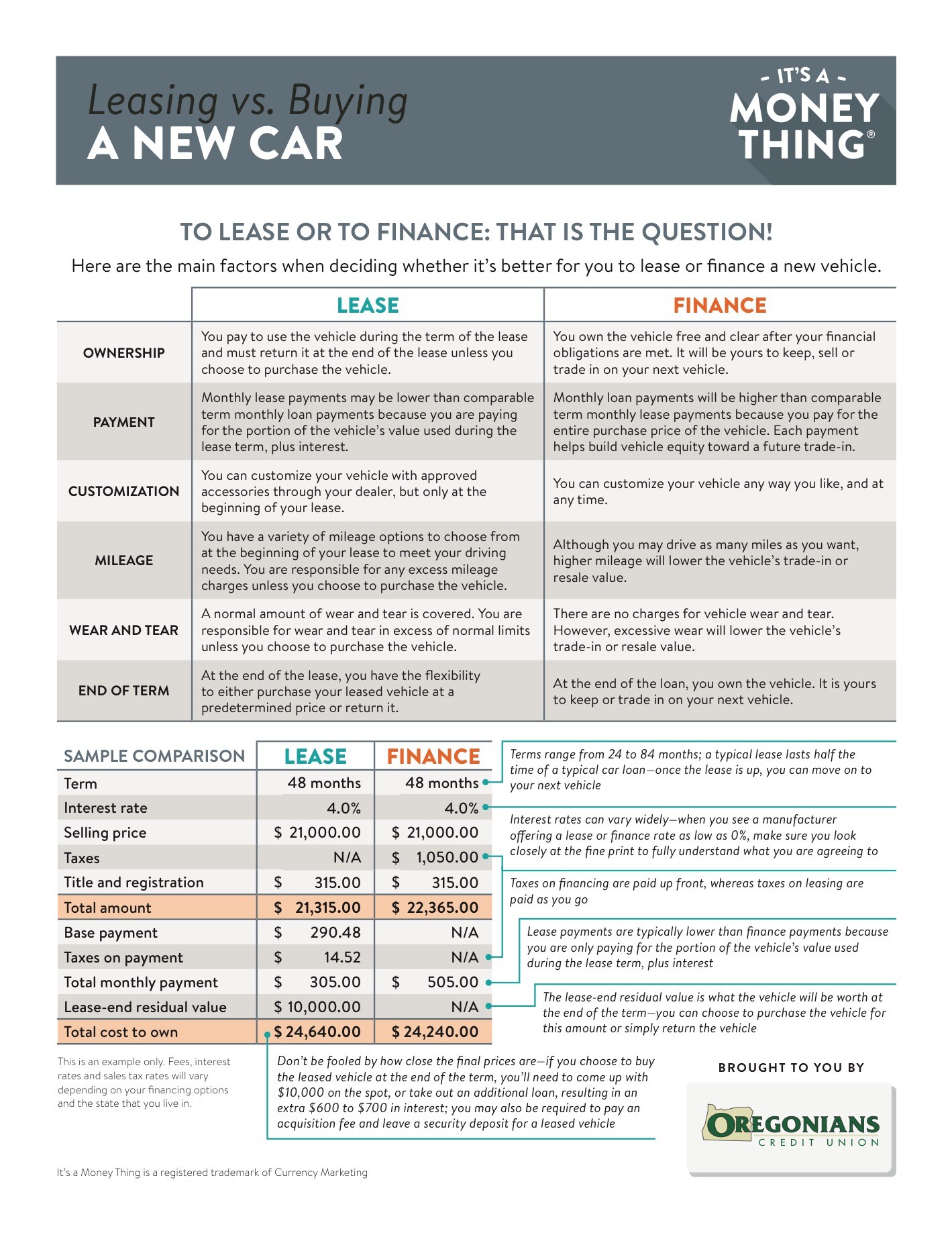

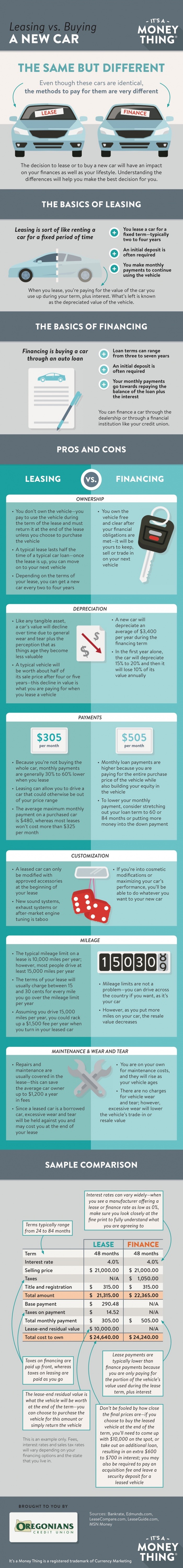

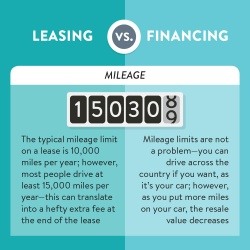

On the surface, the differences between leasing and buying a vehicle seem fairly straightforward. Leasing a car means you’ll usually have access to a new set of wheels every few years; buying it likely means that you plan to drive the same car for a much longer period of time. Leasing usually includes a warranty that covers most of your repairs; buying means accepting larger repair costs, which are inevitable as the car ages. Leasing agreements can limit your mileage and your ability to customize your ride; buying means you can put as many miles as you want on the car and customize it however you’d like.

On the surface, the differences between leasing and buying a vehicle seem fairly straightforward. Leasing a car means you’ll usually have access to a new set of wheels every few years; buying it likely means that you plan to drive the same car for a much longer period of time. Leasing usually includes a warranty that covers most of your repairs; buying means accepting larger repair costs, which are inevitable as the car ages. Leasing agreements can limit your mileage and your ability to customize your ride; buying means you can put as many miles as you want on the car and customize it however you’d like.

Looking only at the comparisons above, you might conclude that buying a car is a more practical and economical option than leasing a car—but if that’s really the case, why are monthly lease payments so much lower (often 40% lower!) than monthly loan payments? Why is leasing considered more expensive in the long term if you’re paying less on a month-to-month basis? To answer these questions, let’s take a look at the concept of depreciation.

Depreciation means a loss of value over time. New cars are a textbook example—you’ve likely heard that a car loses thousands of dollars in value the moment you drive it off the lot. That’s accurate, and that’s depreciation at work (and yes, it can be kind of depressing).

Depreciation means a loss of value over time. New cars are a textbook example—you’ve likely heard that a car loses thousands of dollars in value the moment you drive it off the lot. That’s accurate, and that’s depreciation at work (and yes, it can be kind of depressing).

All cars depreciate in value over time, but the steepest drop happens in the first three to five years, as you can see below:

- Brand new to 5 years old—the car depreciates by 15% to 20% of its value each year

- From 5 years to 10 years—the rate of depreciation slows slightly to 10% to 15% of its value each year

- 10+ years—the rate of depreciation tends to level out to less than 5% a year. By this time, the car is usually worth less than one-fifth of its retail price!

Depreciation takes its toll on the value of every vehicle. However, your decision to lease or buy will have an effect on how that depreciation influences your finances.

Depreciation takes its toll on the value of every vehicle. However, your decision to lease or buy will have an effect on how that depreciation influences your finances.

When you finance a car, you own it once you pay off the loan. This means that you personally take the hit on its depreciation, but it also means you also “own” its residual value. Although that value depreciates over time, if there comes a time when you’re ready to sell it or trade it in, you get the benefit of that resale or trade-in value.

By contrast, when you lease a car, you never actually own it. The company that leases the car to you is responsible for selling the car once you’ve completed your lease term. The leasing company also ultimately deals with the car’s depreciation in value. You get to drive a brand new car without needing to think about its loss in value. That sounds pretty great, right? In reality, even though the leasing company deals with the eventual sale of the car, you’re the one who makes up for its loss in value through your monthly payments. That payment includes an estimate of how much the car will depreciate by the time your term is up. Monthly payments are lower because you’re not paying for the entire car—you’re just paying for how much the car will depreciate in those few years that you’re driving it (a period of time when, coincidentally, the car depreciates the most).

When you finance a car, the monthly payments are higher because you are paying for the entire car, plus interest on the loan. When you pay the loan back, your monthly payments stop (unlike leasing payments, which continue as long as you’re still leasing) and even though your car will have depreciated in value by that point, you will own the remaining value.

When you finance a car, the monthly payments are higher because you are paying for the entire car, plus interest on the loan. When you pay the loan back, your monthly payments stop (unlike leasing payments, which continue as long as you’re still leasing) and even though your car will have depreciated in value by that point, you will own the remaining value.

As with any major financial decision, there are also other factors that come into play. You need to be realistic about your budget and honest about your lifestyle, and you need to figure out what’s most important to you as a new car owner. How comfortable are you with the limitations set by a lease agreement? How prepared are you to pay for eventual car repairs? Will driving a new car every two to three years be worth thousands of dollars more in the long run? To some people, it might be—it all depends on a combination of your personal needs and preferences.

Handout

Here are the main factors when deciding whether it's better for you to lease or finance a new vehicle. Download the PDF printable version here.

Was this information useful? Visit our It's A Money Thing home page for more quick videos and helpful articles to help you make sense of your money, one topic at a time! Check back, new topics will be introduced regularly.

On the surface, the differences between leasing and buying a vehicle seem fairly straightforward. Leasing a car means you’ll usually have access to a new set of wheels every few years; buying it likely means that you plan to drive the same car for a much longer period of time. Leasing usually includes a warranty that covers most of your repairs; buying means accepting larger repair costs, which are inevitable as the car ages. Leasing agreements can limit your mileage and your ability to customize your ride; buying means you can put as many miles as you want on the car and customize it however you’d like.

On the surface, the differences between leasing and buying a vehicle seem fairly straightforward. Leasing a car means you’ll usually have access to a new set of wheels every few years; buying it likely means that you plan to drive the same car for a much longer period of time. Leasing usually includes a warranty that covers most of your repairs; buying means accepting larger repair costs, which are inevitable as the car ages. Leasing agreements can limit your mileage and your ability to customize your ride; buying means you can put as many miles as you want on the car and customize it however you’d like. Depreciation means a loss of value over time. New cars are a textbook example—you’ve likely heard that a car loses thousands of dollars in value the moment you drive it off the lot. That’s accurate, and that’s depreciation at work (and yes, it can be kind of depressing).

Depreciation means a loss of value over time. New cars are a textbook example—you’ve likely heard that a car loses thousands of dollars in value the moment you drive it off the lot. That’s accurate, and that’s depreciation at work (and yes, it can be kind of depressing). Depreciation takes its toll on the value of every vehicle. However, your decision to lease or buy will have an effect on how that depreciation influences your finances.

Depreciation takes its toll on the value of every vehicle. However, your decision to lease or buy will have an effect on how that depreciation influences your finances.

When you finance a car, the monthly payments are higher because you are paying for the entire car, plus interest on the loan. When you pay the loan back, your monthly payments stop (unlike leasing payments, which continue as long as you’re still leasing) and even though your car will have depreciated in value by that point, you will own the remaining value.

When you finance a car, the monthly payments are higher because you are paying for the entire car, plus interest on the loan. When you pay the loan back, your monthly payments stop (unlike leasing payments, which continue as long as you’re still leasing) and even though your car will have depreciated in value by that point, you will own the remaining value.