Loans help finance some of our biggest goals in life. They can provide access to possibilities that we can’t afford upfront—possibilities like going to school, buying a home or starting a business (to name just a few).

A loan is also one of the biggest financial commitments we make in our lifetime. Rushing into a loan without fully understanding how it will affect your budget can create a very stressful situation that can quickly spiral out of control.

The good news is that you can avoid this stress entirely by choosing the loan that’s right for you: a loan you can afford, from a reputable lender, with a payment schedule that makes sense.

The good news is that you can avoid this stress entirely by choosing the loan that’s right for you: a loan you can afford, from a reputable lender, with a payment schedule that makes sense.

Not sure where to start? The five tips below will help you shop smarter for the loan that’s right for you.

1. Take your time

Reading the fine print is not fun, researching loan options is not exactly exciting and asking financial questions can feel intimidating—but these all play an important part in helping you find the right loan product. The process is not easy, and if you’re tempted to rush through it, just remind yourself that being thorough now can save years of financial stress down the road. You should never feel pressured to sign anything on the spot. Remember: this is your loan and your future—you’re in control!

2. Be honest about your budget

In order to choose the right loan, you need to have a clear idea of how much you can comfortably afford to borrow. Spend some quality time with your budget (if you don’t have one, now is a great time to make one). You’ll want to come up with a range, so calculate a few different scenarios:

- If your income and expenses stay exactly the same as they are now, how much of a monthly payment could you afford?

- If you suddenly lost your job, how many payments could you make before running out of cash? Do you have an emergency fund in place?

- Is there an area of your budget where you can reduce spending to cover a planned (or unplanned) increase in your monthly payment?

Picturing your loan payment alongside your other budget items will give you a sense of what you can realistically afford so that you can confidently shop for a loan without worrying about the financial effect on your lifestyle.

3. Give yourself some credit

3. Give yourself some credit

Your credit score plays a huge role in determining the loan rate you qualify for. Additionally, knowing your credit score before you go loan shopping will save you some time by making it easy to weed out offers you’re not eligible for. In the meantime, keep up those good credit habits: pay your bills in full and on time, and try to use only 10% of your available credit limit each month.

4. Do some research

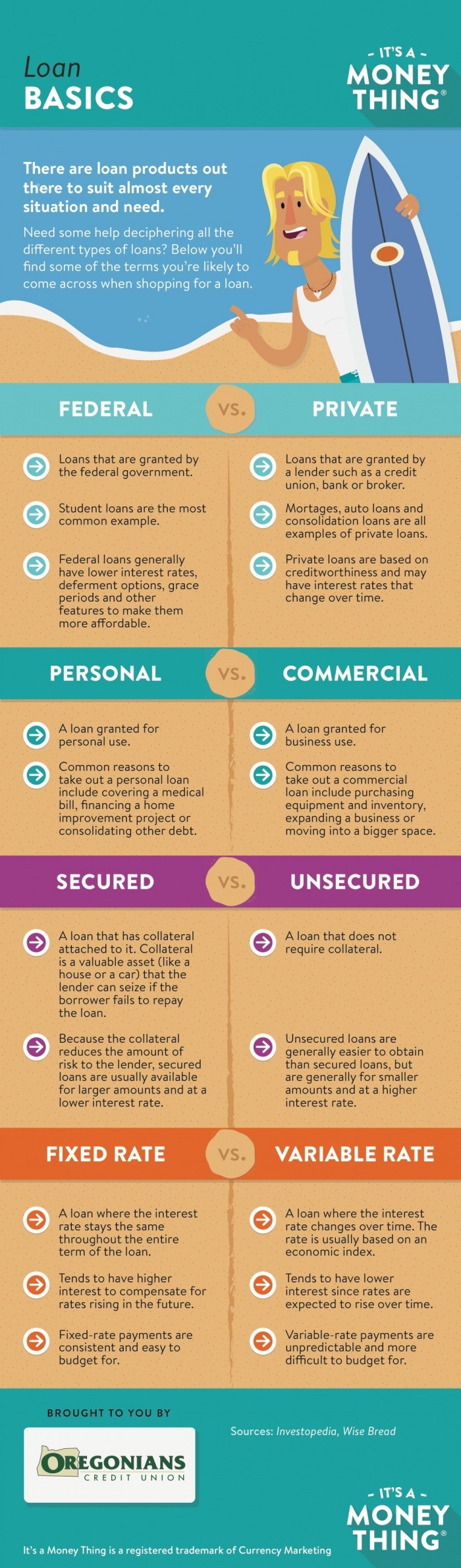

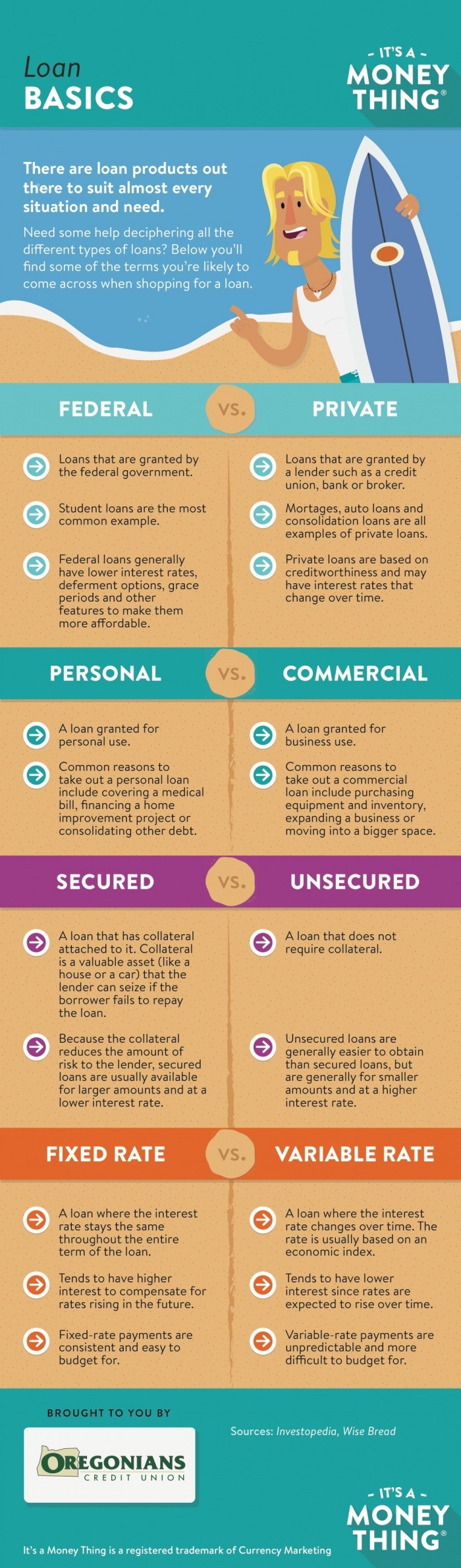

Start with brushing up on some basic loan terminology and then move on to learning about different types of loans (such as secured loans, unsecured loans, fixed-rate loans and variable-rate loans). Research loans online to get an idea of the interest rates for the products you’re interested in. When comparing various loans, look at more than just the Annual Percentage Rate (APR). Consider the fees, the payment schedules, the eligibility requirements, and the application and approval process. Also, check out the history and reputation of the various lenders—especially if you stumble upon offers that seem too good to be true.

5. Check in with Oregonians

Credit unions are known for offering competitive rates on loans. You may also qualify for discounts based on your existing membership or because you have other banking products with your credit union.

Once you’ve done your research and you know your budget inside and out, then arrange to meet with a loan officer. And bring a ton of questions with you! Don’t be shy—ask about any wording you don’t understand. Ask for your lender’s opinion and ask if they’ve worked with someone in a similar situation as yours. To really put your loan in context, ask a variety of “What happens if…?” questions:

- What happens if I miss a payment?

- What happens if I default?

- What happens if I want to pay off the loan faster than expected?

- What happens if I pay weekly instead of monthly?

The most important thing to remember is that taking out and repaying a loan is not intended to be a stressful experience—it’s intended to make large purchases or investments affordable for you. It’s easy to get sucked into horror stories about things like foreclosures and student debt, but a little knowledge and preparation will make your own loan story a lot happier and a lot less dramatic. So study up, focus on your specific needs and ask around—your perfect loan is out there!

Activity

Was this information useful? Visit our It's A Money Thing home page for more quick videos and helpful articles to help you make sense of your money, one topic at a time! Check back, new topics will be introduced regularly.

The good news is that you can avoid this stress entirely by choosing the loan that’s right for you: a loan you can afford, from a reputable lender, with a payment schedule that makes sense.

The good news is that you can avoid this stress entirely by choosing the loan that’s right for you: a loan you can afford, from a reputable lender, with a payment schedule that makes sense. 3. Give yourself some credit

3. Give yourself some credit