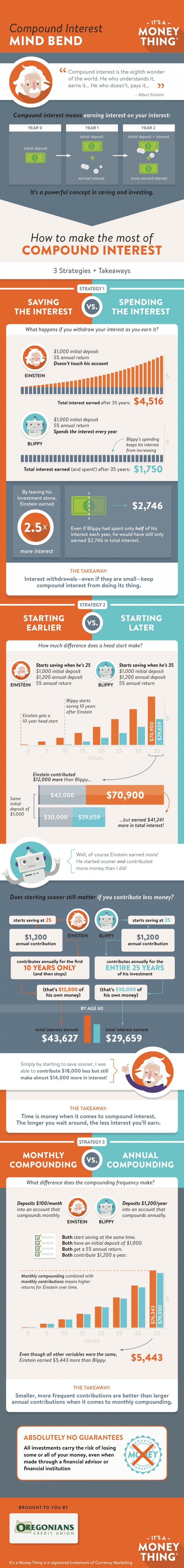

In case you haven’t heard, compound interest is the best.

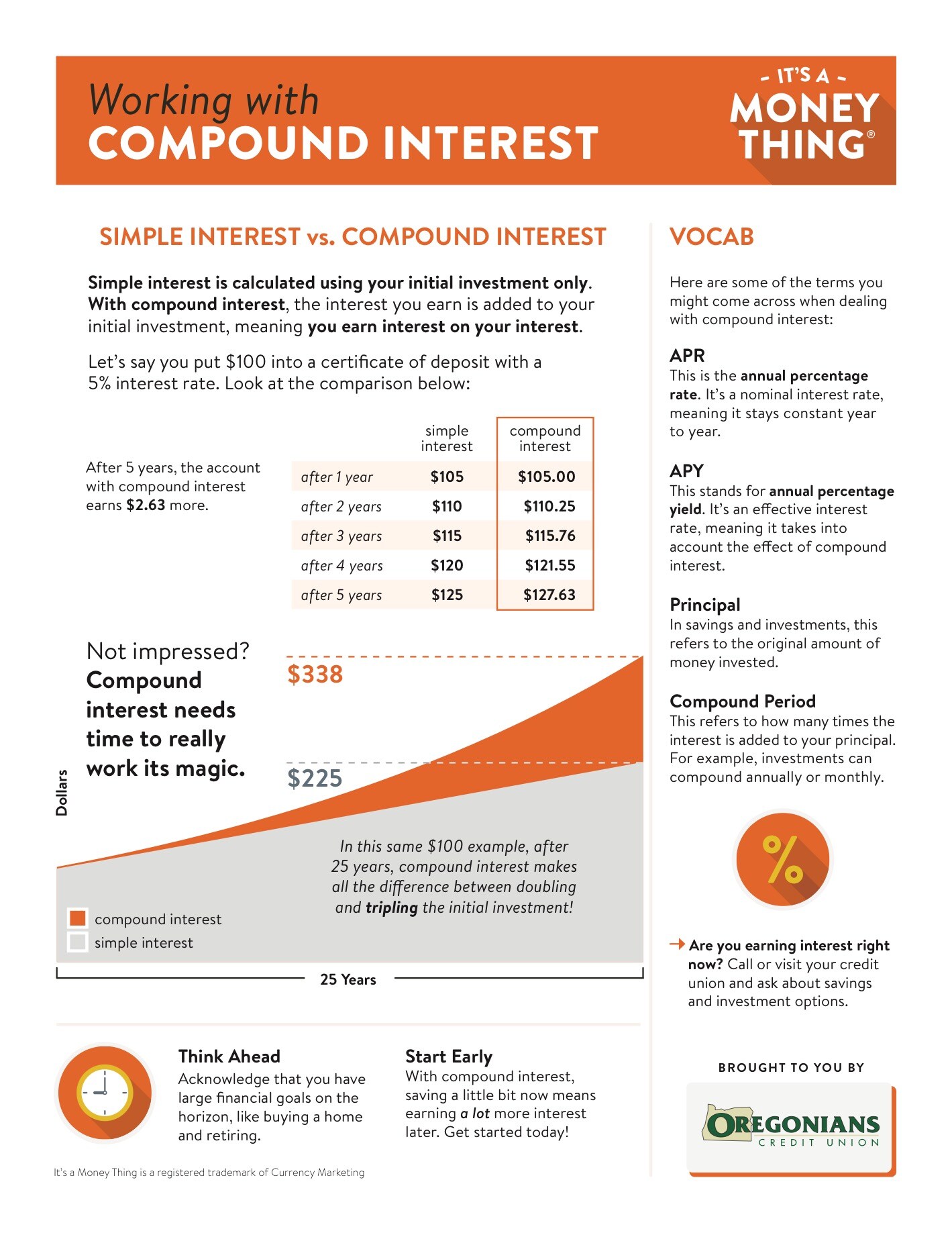

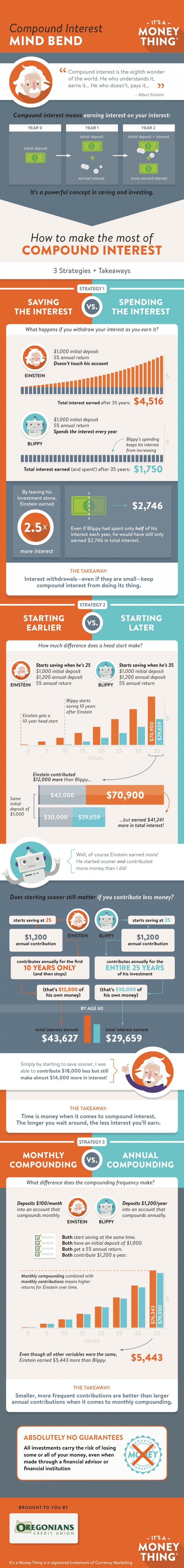

You may remember it as an equation you had to memorize for math class, but it’s so much more than that. It’s the concept that powers all sorts of savings and investment products and, over time, allows you to turn your money into, well, more money!

Even though compound interest is easy to understand—compound interest = more money for you!—those who can potentially benefit most from it (those in their teens and 20s) don’t seem to be taking advantage of it. Savings contributions and retirement savings participation rates are falling among young adults.

So if we understand that compound interest translates into free money down the road, what could possibly be standing in the way?

As it turns out, it’s not so much a math or finance issue as it is a life issue—if we have trouble identifying our life goals, we’ll also have trouble planning and saving for them. At the risk of sounding like Dr. Phil, we need to understand ourselves before we can fully understand our finances.

Acknowledge the big picture

This is a tough one, because a lot happens between your teens and your 30s. You’ll experience a combination of moving out, starting your career, dealing with student loans, getting married, financing a home—all these things have their own set of stresses that make it difficult to see past them. When you’re a new grad and job hunting, it’s hard to imagine yourself retiring in 40 years. If you’re living with your family rent-free, it’s hard to imagine yourself putting down a deposit on a home. If you’re living paycheck to paycheck, it’s hard to imagine having enough to pay off your student loans.

This is a tough one, because a lot happens between your teens and your 30s. You’ll experience a combination of moving out, starting your career, dealing with student loans, getting married, financing a home—all these things have their own set of stresses that make it difficult to see past them. When you’re a new grad and job hunting, it’s hard to imagine yourself retiring in 40 years. If you’re living with your family rent-free, it’s hard to imagine yourself putting down a deposit on a home. If you’re living paycheck to paycheck, it’s hard to imagine having enough to pay off your student loans.

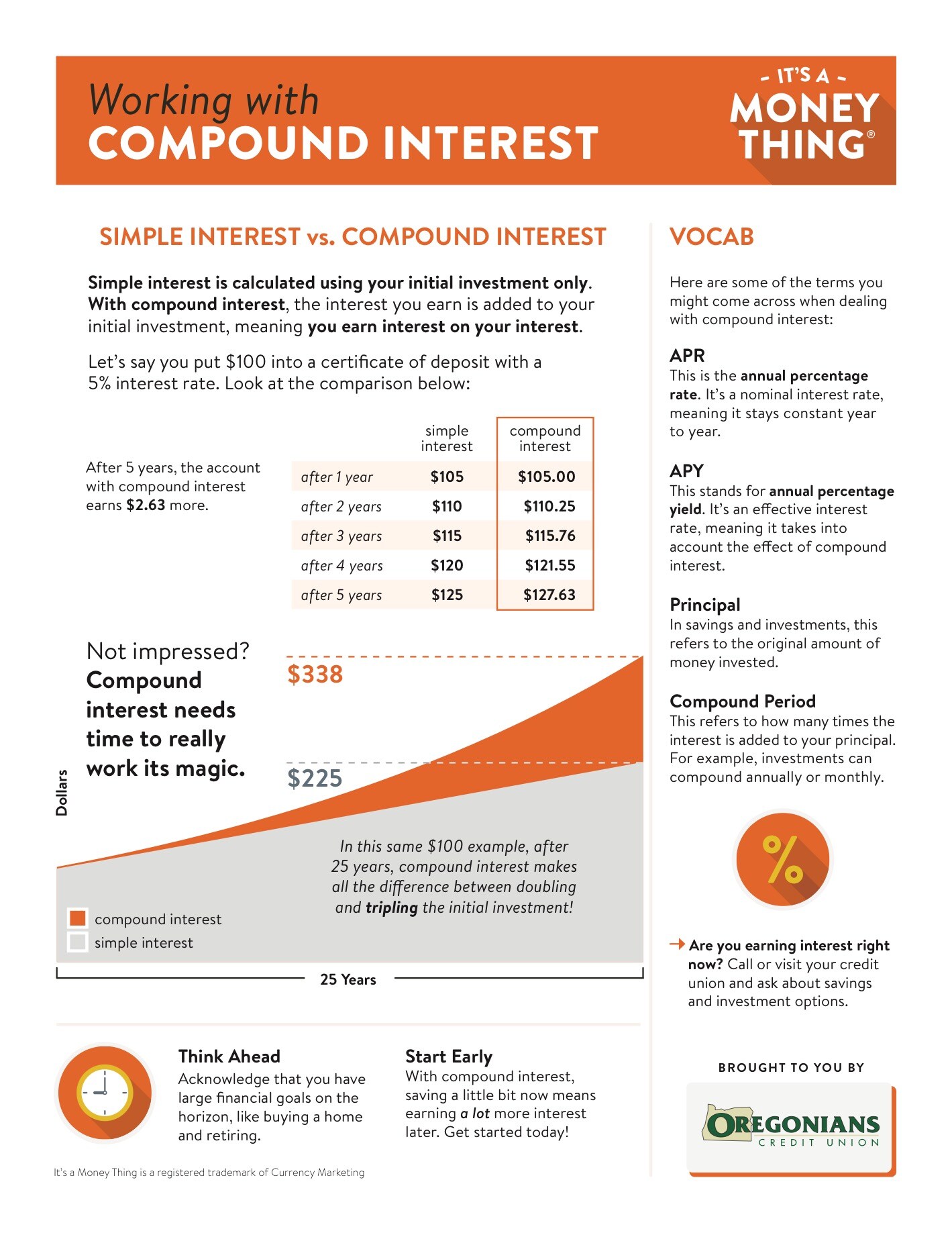

The first step is to acknowledge that you want these things, even if they seem impossible right now. You want to retire comfortably. You want to buy a home. You want to live debt-free. You may even want to travel or go back to school. These goals may seem far away, but they’re definitely there and they’re certainly not going away. Every day that goes by is one day closer to the time when you want to achieve those goals.

The good news is that a little bit of your time and energy now can go a long way later. Make an appointment with your credit union to learn about their savings products. Take 10 minutes and set up a direct deposit into your savings account. When you’re dealing with compound interest, the longer you wait to get started, the less money you’ll earn in the long run.

Lack of clarity is self-sabotage

If you’re already at the stage where you can see the big picture, it’s time to get specific. You know you want to save for your retirement—great! But how much is that, exactly? $350,000? A million dollars? More? Do you have any idea?

These questions aren’t meant to overwhelm you, but if they caught you off guard, that means it’s time to add some real dollar amounts and real timelines to your big-picture goals. For example, you could turn “saving for home ownership” into “saving $50,000 in the next 12 years for a down payment on a home”.

Details make your goals more tangible, more immediate and, therefore, easier to commit to. Take a little time, do a little research and turn your big picture into something you can start on right now.

Don’t let decisions overwhelm you

Not many people enjoy making decisions—especially when it comes to life changes and major financial commitments. It’s easy to understand why—decision-making is scary (not so much the actual “deciding” part, but more the “fear-of-making-the-wrong-decision-and-regretting-everything-forever” part).

Not many people enjoy making decisions—especially when it comes to life changes and major financial commitments. It’s easy to understand why—decision-making is scary (not so much the actual “deciding” part, but more the “fear-of-making-the-wrong-decision-and-regretting-everything-forever” part).

Savings goals require you to make a lot of big decisions. You need to choose goals to focus on, you need to choose between different banking products and you need to choose how to distribute your savings contributions. Sometimes the choices are brutally blunt, such as choosing between owning a car and paying off your credit card debt.

The important thing is to not let all that decision-making overwhelm you. Remember: just by facing those decisions, you’re making progress, because you’re establishing what’s most important to you and you’re renewing your commitment to your goals.

Activity

Click on the image to view the printable PDF.

Was this information useful? Visit our It's A Money Thing home page for more quick videos and helpful articles to help you make sense of your money, one topic at a time! Check back, new topics will be introduced regularly.

This is a tough one, because a lot happens between your teens and your 30s. You’ll experience a combination of moving out, starting your career, dealing with student loans, getting married, financing a home—all these things have their own set of stresses that make it difficult to see past them. When you’re a new grad and job hunting, it’s hard to imagine yourself retiring in 40 years. If you’re living with your family rent-free, it’s hard to imagine yourself putting down a deposit on a home. If you’re living paycheck to paycheck, it’s hard to imagine having enough to pay off your student loans.

This is a tough one, because a lot happens between your teens and your 30s. You’ll experience a combination of moving out, starting your career, dealing with student loans, getting married, financing a home—all these things have their own set of stresses that make it difficult to see past them. When you’re a new grad and job hunting, it’s hard to imagine yourself retiring in 40 years. If you’re living with your family rent-free, it’s hard to imagine yourself putting down a deposit on a home. If you’re living paycheck to paycheck, it’s hard to imagine having enough to pay off your student loans.

Not many people enjoy making decisions—especially when it comes to life changes and major financial commitments. It’s easy to understand why—decision-making is scary (not so much the actual “deciding” part, but more the “fear-of-making-the-wrong-decision-and-regretting-everything-forever” part).

Not many people enjoy making decisions—especially when it comes to life changes and major financial commitments. It’s easy to understand why—decision-making is scary (not so much the actual “deciding” part, but more the “fear-of-making-the-wrong-decision-and-regretting-everything-forever” part).