5 Ways to Lower the Cost of Tuition Before Considering a Student Loan

If you’re considering financing your college education with the help of a student loan, the smartest thing you can do for yourself is to only borrow what you truly need. (This advice applies to pretty much all loan products, by the way.) Pursuing post-secondary education should be an exciting time in your life. You’re making decisions and opening up possibilities that will shape your future—a future that is adventurous and fulfilling and that decidedly does not include years and years of crippling debt.

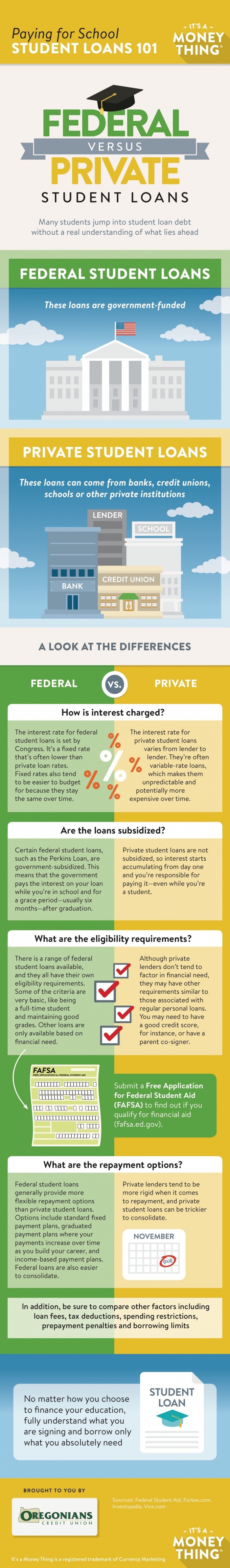

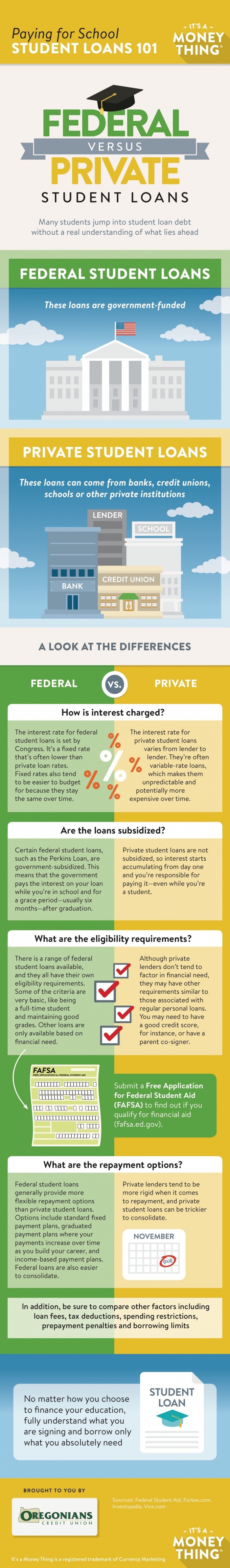

For many young adults, student loans serve as the first real experience with borrowing a large amount of money. It’s a steep learning curve for someone just starting out, and not understanding financial concepts like interest rates, loan terms and repayment schedules can quickly snowball into a very stressful and costly post-graduation experience.

Although there are things you can do during your time as a student to soften the sting of student loan repayment (working part-time while in school and sharpening those budgeting skills are two solid strategies), why not get the process started even sooner? The following tips will take a bite out of your total education costs and reduce your dependence on outside financing—and they can all be put into action long before Orientation Day rolls around.

1) Do the Two-Step

(No, we’re not referring to the dance.) The college two-step means splitting your studies between two schools. You start by attending a more affordable institution for your general education courses, and then transfer to your school of choice to complete your degree (one example of this in practice is earning an associate’s degree at a community college and then transferring into a bachelor’s degree program at a university). This way, you save some money on introductory-level courses and reserve the big bucks for the specialized instruction that comes in the latter half of your academic career.

2) Go for Extra Credit

Find out if there are any opportunities to earn college credits while still in high school. Beyond reducing college tuition costs, advanced college credit programs are an excellent way to explore your interests more seriously and to get a sneak preview of what your college workload will look like. If you’re already out of high school, find out if any colleges or universities in your area offer summer courses at reduced tuition—that could be an alternative way to score some credits before September.

3) Seek Out Scholarships

Apply for every form of scholarship, grant and tuition waiver that you’re eligible for. It’s never too early to start your scholarship search—reach out to your high school guidance counselor or the financial aid coordinator at the college you wish to attend. Visit scholarship search engines and online resources. Reach out to your current employer and your family members—you never know, there may be some form of tuition subsidy or grant opportunity available to you through an employer or alumni network. Be exhaustive in your search and approach each application with the same level of enthusiasm and optimism—even the smallest awards and prizes will add up. It’s free money, and it’s there for the taking.

4) Location Scout

Geography can play a significant role in determining your total education costs. A single school may have different tuition rates for in-state, out-of-state and international students. Generally speaking, staying in-state is usually the most affordable option—in addition to saving on tuition, you can also sidestep some of the larger expenses associated with studying abroad (like travel costs, meal plans and living in residence). Of course, there are plenty of non-financial incentives for studying abroad, but it’s important to understand just how much the location of your school will affect your bottom line.

5) Double Down

Some schools offer accelerated programs that enable you to complete a four-year degree in just three years. This is a great option to consider—that’s one less year of tuition to pay!—but bear in mind that you’ll be squeezing more classes into a shorter period of time. The intensive schedule might make it difficult to accommodate a job while you’re in school, for example, so weigh your options carefully before committing to a more ambitious schedule.

The tips outlined above represent thousands of dollars of potential savings. Whether you’re a first-time student or a returning student, it’s in your absolute best interest to whittle down your education costs as much as possible before considering a student loan or alternative financing option. Your future self will thank you.

Was this information useful? Visit our It's A Money Thing home page for more quick videos and helpful articles to help you make sense of your money, one topic at a time! Check back, new topics will be introduced regularly.