Guaranteed Deposits

It's a Money Thing Lesson #49

Certificates of Deposit are a Solid Investment for Young Adults

As a young adult, you may have heard the phrase “investing in the stock market” many times, but you may not be sure what it means. Investing in the stock market means buying stocks, which are shares of ownership in a company. Stocks can be risky investments because their value can go up or down quickly, depending on various factors, such as economic conditions, company performance and investor sentiment. Therefore, investing in the stock market can be intimidating, especially if you are risk-averse or have limited knowledge of the market.

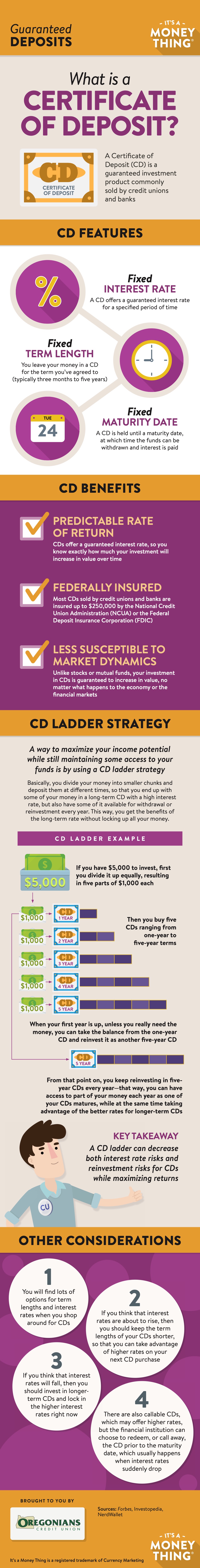

A safer and less volatile alternative to investing in the stock market is investing in Certificates of Deposit (CDs) through your credit union or bank. CDs are financial products that offer a fixed interest rate and a specific term. CDs can be a good investment option for young adults who want to earn a guaranteed return on their money.

Here are some reasons to consider investing in CDs:

#1 Guaranteed Returns: Unlike stocks, which can fluctuate in value, CDs offer a fixed rate of return that is guaranteed by the issuing credit union or bank. This means that you know exactly how much interest you will earn on your investment, and you can calculate your return in advance. This predictability can be comforting for young investors who are looking for a stable investment option.

#2 NCUA of FDIC Insurance: CDs are insured by the National Credit Union Administration (NCUA) or the Federal Deposit Insurance Corporation (FDIC). These are government agencies that protect consumers' deposits in case their credit union or bank fails. NCUA or FDIC insurance covers up to $250,000 per depositor, per insured credit union or bank.

#3 Low Risk: CDs are considered a low-risk investment because they are not affected by market fluctuations. Unlike stocks, which can go up or down based on economic conditions, company performance or other external factors, CDs offer a fixed rate of return regardless of market conditions. This means that your investment is not exposed to the same level of risk as stocks, which can be comforting for young investors who are just starting to build their portfolios.

#4 Variety of Terms: CDs come in a variety of terms, ranging from a few months to several years. The longer the term of the CD, the higher the interest rate tends to be. This means that young investors can choose the term that best fits their financial goals and investment timeline. For example, if you are saving for a short-term goal, such as a down payment on a house, you may choose a CD with a shorter term, such as six months or a year. If you are saving for a long-term goal, such as retirement, you may choose a CD with a longer term, such as five or 10 years.

#4 Variety of Terms: CDs come in a variety of terms, ranging from a few months to several years. The longer the term of the CD, the higher the interest rate tends to be. This means that young investors can choose the term that best fits their financial goals and investment timeline. For example, if you are saving for a short-term goal, such as a down payment on a house, you may choose a CD with a shorter term, such as six months or a year. If you are saving for a long-term goal, such as retirement, you may choose a CD with a longer term, such as five or 10 years.

#5 Easy to Open: CDs are easy to open and require minimal effort from the investor. To open a CD, you simply need to find a credit union or bank that offers CDs, choose the term and interest rate that you want, and deposit your money. Unlike stocks, which require research and analysis, CDs do not require any special knowledge or expertise; however, it is essential to do your research and choose a reputable institution with competitive rates and terms that suit your investment goals.

Investing in Certificates of Deposit can be a safe and reliable alternative to investing in the stock market for young adults. CDs provide a guaranteed rate of return, are backed by the NCUA or FDIC, and offer a predictable income stream. They are ideal for those who are risk-averse or who prefer a steady income stream. By investing in CDs, you take a step toward securing your financial future and achieving your long-term investment objectives.

Was this information useful? Visit our It's A Money Thing home page for more quick videos and helpful articles to help you make sense of your money, one topic at a time! Check back, new topics will be introduced regularly.